Articles and News

Should I Elect S Corp Status in 2026?

With most major TCJA provisions now permanent under OBBBA, year-end planning is no longer about expiring breaks — it’s about aligning income, deductions, and timing to your specific situation. Business owners and individuals who act before December 31 can still capture major benefits in Q4 2025.

How to Close Your Books and Start the New Year Strong

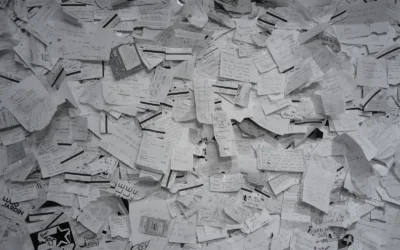

As the year comes to a close, organizing your business receipts and financial records is key to a smooth tax season. Collect and categorize all documents, digitize receipts, reconcile accounts, and review expenses. With everything in order, you’ll gain clearer insights and set up next year for success.

Your 2026 Tax Calendar: Proactive Moves

With most major TCJA provisions now permanent under OBBBA, year-end planning is no longer about expiring breaks — it’s about aligning income, deductions, and timing to your specific situation. Business owners and individuals who act before December 31 can still capture major benefits in Q4 2025.

How to Organize Business Receipts and Records Before Year-End

As the year comes to a close, organizing your business receipts and financial records is key to a smooth tax season. Collect and categorize all documents, digitize receipts, reconcile accounts, and review expenses. With everything in order, you’ll gain clearer insights and set up next year for success.

3 Questions to Ask Your CPA Before Year-End

October marks the beginning of one of the most important times on the tax calendar: year-end planning season. With just a few months left before December 31, you still have the opportunity to take meaningful steps to reduce your 2025 tax bill, improve cash flow, and position yourself for success in 2026.

Essential Bookkeeping Software for Small Businesses

Running a small business in today’s fast-paced economy requires more than just keeping good records—it demands accurate, efficient, and accessible financial management. Bookkeeping software has become a must-have tool, helping business owners track income, manage expenses, and stay compliant without drowning in spreadsheets.

Don’t Miss Out — Why Year-End Tax Planning Matters in 2025

As 2025 comes to a close, now is the time to review your finances and make smart moves that could lower your tax bill. Year-end tax planning is about being proactive — taking advantage of deductions, credits, and strategies that expire when the clock strikes midnight on December 31.

DIY Bookkeeping vs. Hiring a Professional

As a business owner, one of the most important responsibilities you have is knowing and understanding your financials. Your numbers tell the story of your business—whether you’re profitable, where your money is going, and how healthy your cash flow really is. Without this knowledge, it’s nearly impossible to make smart decisions or plan for long-term success.

A Beginner’s Guide to Keeping Your Finances in Order

Whether you’re a new business owner or a freelancer just starting out, bookkeeping may sound overwhelming. But don’t worry—it doesn’t require an accounting degree to keep your finances organized. With the right foundation, good bookkeeping can save you time, money, and stress in the long run.